Little Known Questions About Short-term Loan copyright.

Wiki Article

The 7-Second Trick For Short-term Loan copyright

Table of Contents5 Easy Facts About Short-term Loan copyright ExplainedThe Greatest Guide To Short-term Loan copyrightA Biased View of Short-term Loan copyrightSee This Report about Short-term Loan copyrightHow Short-term Loan copyright can Save You Time, Stress, and Money.Not known Factual Statements About Short-term Loan copyright

The estimations and amortization routine created are: (i) based on the accuracy as well as completeness of the data you have gone into, (ii) based upon presumptions that are thought to be affordable, as well as (iii) for estimate functions just as well as must not be trusted for certain economic or various other recommendations. When you make your credit scores application, rates of interest may have changed or might be various as a result of details had in your application.

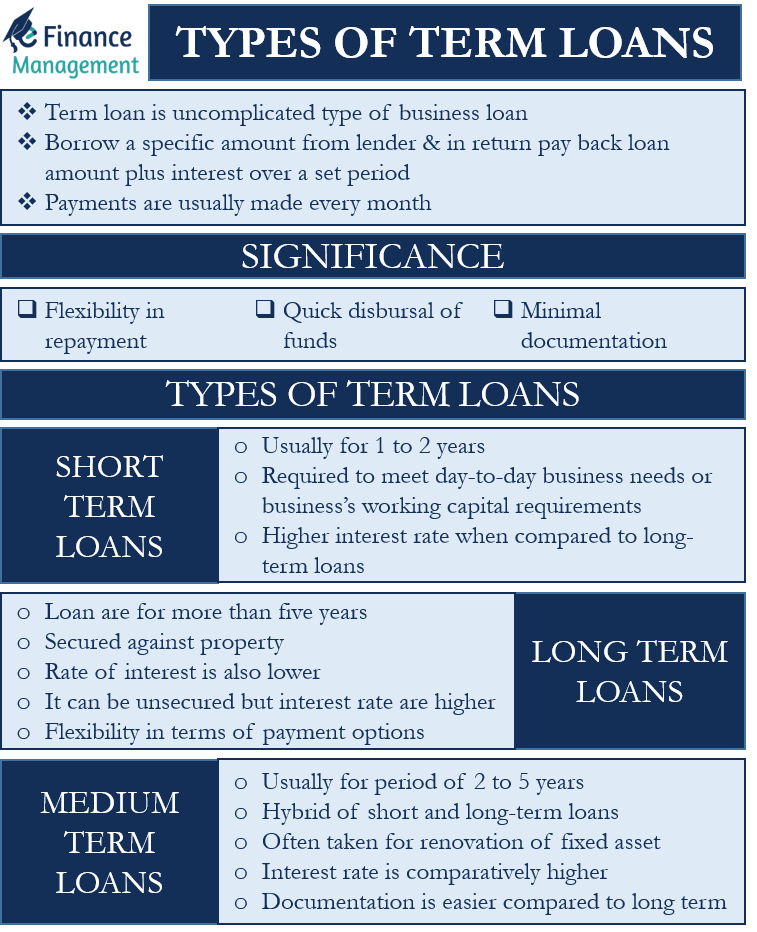

They are unsafe lendings, implying that you don't need to secure your lending against your residence or auto or any kind of other residential property. If you secure a short-term car loan you are required to settle the very same amount each month to the lending institution till the funding as well as the interest are settled.

Some Known Facts About Short-term Loan copyright.

9% You then are needed to settle 178. 23 to the loan provider every month for the next 3 months. After the 3 months you will have settled a total of 534. 69. So, it would certainly have cost you 34. 69 to obtain that 500. At Cash, Woman, we make finding a temporary loan quick as well as very easy.We then provide your application to the 30+ lending institutions on our panel to find the loan provider more than likely to approve your application, at the best APR offered to you. We will certainly after that route you straight to that lending institutions website to complete your application. Our service is complimentary and also many thanks to our soft search modern technology has no influence on your credit history.

A payday advance loan is a financing that is to be repaid by your next payday. By comparison, a temporary lending is spread over two or more months. For lots of people, spreading the cost over several months makes the lending repayments more cost effective. These financings are specifically intended for scenarios where you have an essential expenditure, however you don't currently have the funds available to spend for it.

5 Easy Facts About Short-term Loan copyright Explained

The Best Strategy To Use For Short-term Loan copyright

If you are comparing lendings online, you might discover that the rates of interest on brief term financing items look high when compared to headline financing prices promoted by high road financial institutions or building cultures. One crucial reason for this is that short-term loan providers deal with offering to those with poor credit score profiles or no credit scores history in any way.This is true of any type of loan or credit report item, not simply temporary lendings. Conversely, if you satisfy all your settlements in complete and also on time after that this could indicate that you can be trusted to navigate here manage credit report well and also might raise your credit rating score.

If you satisfy all these requirements, then indeed you are eligible to use. If you are having problem with your funds and also stressed concerning your financial debts after that there are a variety of organisations that you can transform to for complimentary as well as objective recommendations. See the web links listed below.

What Does Short-term Loan copyright Do?

Cash advance are temporary finances of as much as $1,500 provided for a post-dated paycheque or other pre-authorized debit that the lender makes use of for future payment of the car loan, plus any rate of interest and costs. If the cash advance is not settled in a timely manner, it can result in more passion and also costs. short-term loan copyright.For instance, if you obtain $500 for a cash advance, you can be charged up to $75 in passion and costs. This may not feel like a whole lot of money, however the brief period of a payday advance implies they have a lot higher interest fees than various other sorts of financings.

Let's determine what a payday advance can cost you. Say that: The amount of your following paycheque will certainly be $1,000 You would love to obtain a payday advance loan for $300 The charge to obtain the financing is $45 The total cost to pay back the financing is $345. That means the amount you will get from your following paycheque will certainly be $655.

Short-term Loan copyright - An Overview

Cash advance lending institutions are managed in B.C., suggesting any kind of firm that uses cash advance financings must be licensed and also adhere to legislations set by the provincial federal government. You can inspect to see if a business is licensed with this. Business has to additionally show the licence any place it uses payday advance loan, whether online or in-person.If you have questions or interest in a cash advance funding or loan provider, contact Customer Security BC.

If high inflation is pressing your budget, you aren't alone. A current survey by Finder found that 36 percent of Canadian consumers claimed their primary factor for securing a car loan is to cover bills for lease, mortgage, food and also transportation. With rising cost of living at 7. 6 per cent, several Canadians are looking to loans to spend for necessities.

Report this wiki page